Video: Commercial & Financial Intelligence

Inter-company credit is one of the main sources of short-term financing in France. Yet, granting a payment deadline means taking a risk. If your client does not pay or pays very late, your outstanding receivable puts a strain on cash flow.

Pierre Pelouzet, companies mediator (in France), confirms that “every day, 30 to 40 SMEs close in France due to late payments”.

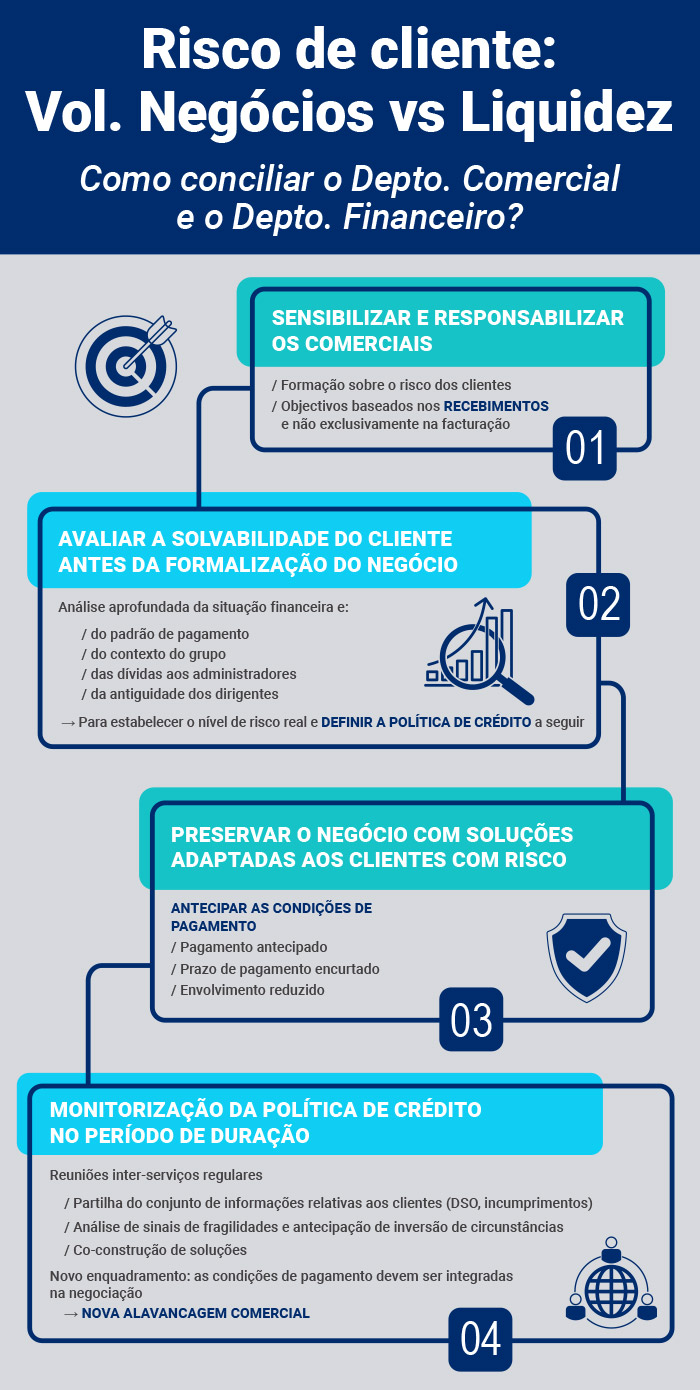

Before extending credit, it is therefore vital to evaluate the solidity of your partner and its capacity to pay its bills on time.

This is where financial and market intelligence comes in. The objective is to evaluate the financial health of clients or future clients, to anticipate their payment behaviour in order to reduce risks of default and adapt the credit conditions extended to secure payments.

Notre force est d’aller bien au-delà des comptes publiés par les entreprises que l’on peut retrouver via les bases de données par exemple.

Nos études de solvabilité entre

Our strength lies in the fact that we go way beyond accounts published by companies, which can be found for example in databases.

Our credit investigations are based on an indepth investigation by our analysts. To ensure optimum quality of the information provided, our strength lies in the fact that we multiply sources (legal sources, press, web) and cross-reference this information with interviews of the various stakeholders in the company investigated.

In particular, and as a priority, we interview:

- the CEO or the Financial Director of the company itself, so that he/she can inform us of the latest trends in terms of financial results;

- the company’s suppliers, in order to identify any late payments;

- and its financial partners.

Where applicable, the analysis will be completed with an investigation on payment behaviour.

Analysis of solvency is therefore conducted using data that has been verified and updated. This analysis is carried out in real time while also providing a short- or medium-term projection of the company’s situation. The results are pragmatic and operational. We deliver the complete investigation with accurate transcriptions of our sources, as well as a solvency or financial rating and a recommended credit limit.

This real-time financial rating gives companies a threefold advantage:

Thanks to the visibility given to a prospect’s real situation, sales staff can do business and develop turnover with companies considered from the outset to be “risky”; for example, companies that do not publish their accounts or whose data is obsolete. In this regard, our credit investigations are really complementary to databases.

Secondly, it is an opportunity for all Credit Managers to fine-tune credit policy. The amount of outstanding amounts agreed and payment conditions can be tailored to suit client typology. This makes it possible to favour volume of business while minimizing risks.

Lastly, our intelligence can also be guaranteed. In other words, in the event of non-payment, we conduct debt collect and indemnification. This is a means to cover risks of default in the event of refusal by credit insurance companies for example, or insufficient insurance coverage.

Financial Intelligence

Evaluate the financial health of your partners to protect yourself from default risks and adapt your intercompany credit conditions.

READ MORE